Robin Hood Investors Conference

Overview

The Robin Hood Investors Conference gathers attendees for a conference focused on actionable insights. The speaker lineup features leaders in investing, tech, business, policy, academia and more to share perspectives on our rapidly changing world in a variety of formats including fireside chats and panels.

Date & Time

October 23, 2024

Location

Spring Studios

Highlighted Speakers

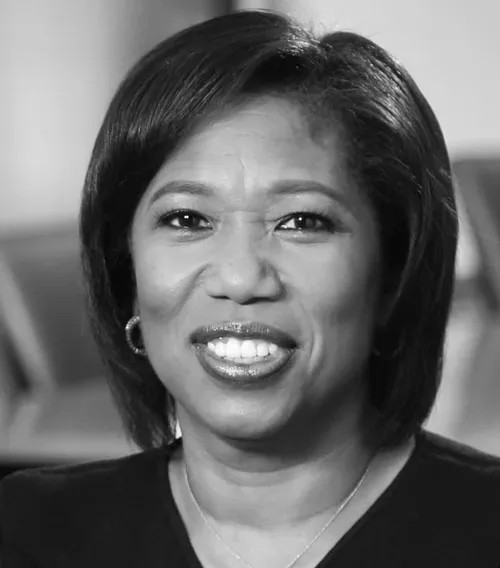

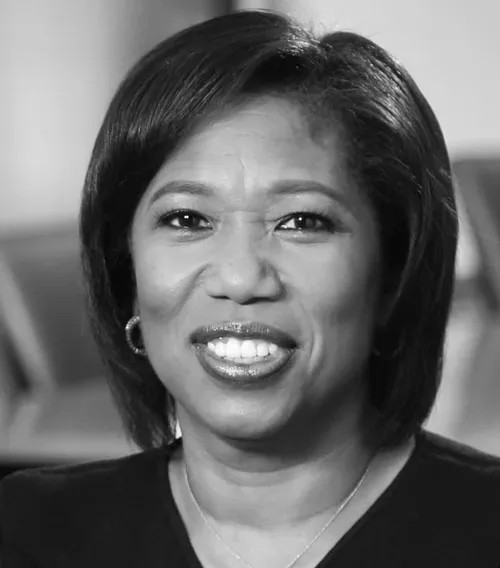

Angela Aldrich

Founder & Managing Partner

Bayberry Capital Partners

Angela Aldrich

Founder & Managing Partner

Angela is the Founder, Managing Partner, and Portfolio Manager at Bayberry Capital, an investment firm based in New York, NY. Bayberry invests in global equities through a fundamental, primary research-driven process. The firm runs a concentrated portfolio of high-conviction single-name longs and shorts across industries and geographies.

Prior to founding Bayberry, Angela spent almost six years as a Managing Director at Blue Ridge Capital. Previously, she worked at Goldman Sachs in their investment banking division, and was a pre-launch member of the investment team at BDT Capital. Angela holds a B.S. in Economics from Duke University and an MBA from the Stanford Graduate School of Business.

Stanley F. Druckenmiller

Chairman and CEO

Duquesne Family Office, LLC

Stanley F. Druckenmiller

Chairman and CEO

Stanley F. Druckenmiller is Chairman and CEO of Duquesne Family Office LLC. Mr. Druckenmiller founded Duquesne Capital Management in 1981, which he ran until he closed the firm in 2010. From 1988 to 2000, he was a Managing Director at Soros Fund Management, where he served as Lead Portfolio Manager of the Quantum Fund, Chief Investment Officer (1989-2000), and was responsible for funds with a peak asset value of $22B. In his early career, he worked at Pittsburgh National Bank and The Dreyfus Corporation.

Mr. Druckenmiller is Chairman Emeritus of the Board of the Harlem Children’s Zone; Chairman of Blue Meridian Partners; a Board member for Memorial Sloan Kettering and the Environmental Defense Fund; on the Investment Committee of Bowdoin College; and is Co-founder and Board member of Kasparov Chess Foundation. He graduated magna cum laude from Bowdoin College with degrees in Economics and English, and holds graduate degree credits in Economics from the University of Michigan.

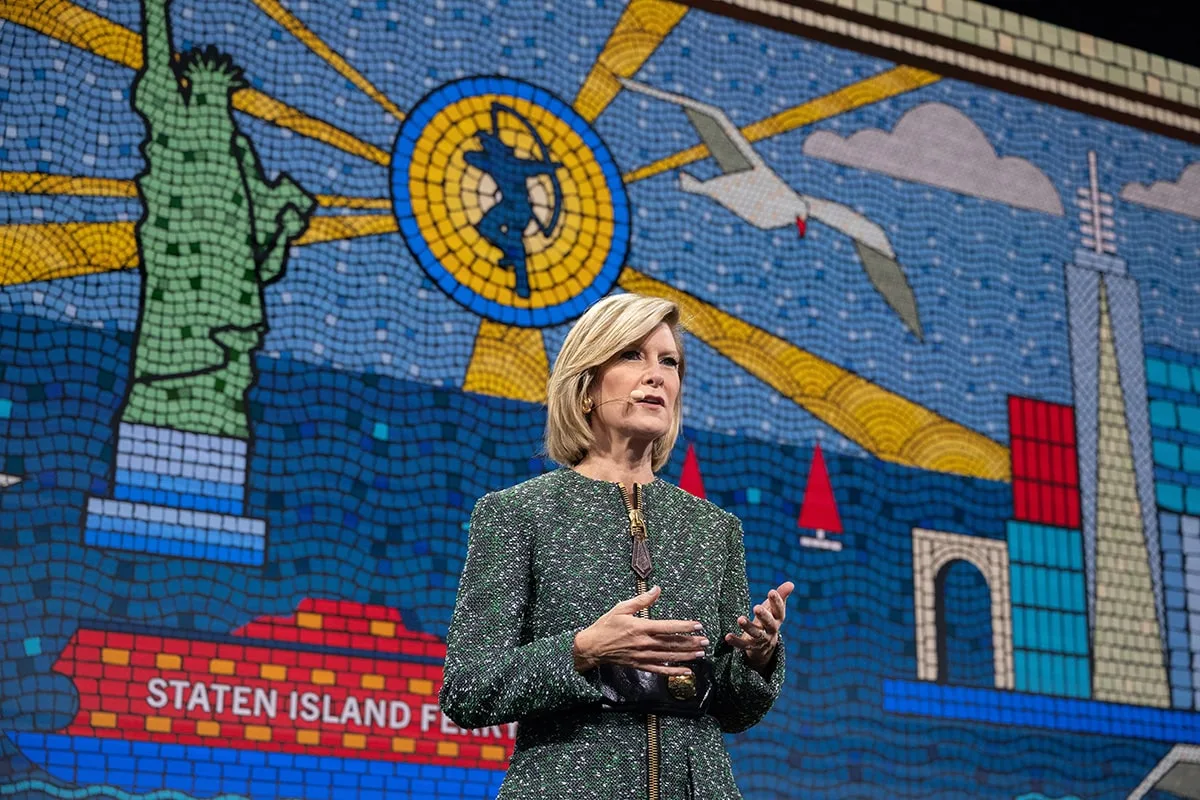

Mary Callahan Erdoes

CEO, Asset & Wealth Management

J.P. Morgan

Mary Callahan Erdoes

CEO, Asset & Wealth Management

Mary Callahan Erdoes is Chief Executive Officer of JPMorgan Chase’s Asset & Wealth Management line of business – one of the largest and most respected investment managers and private banks in the world, with $4.3 trillion in client assets and a 200-year-old legacy as a trusted fiduciary to corporations, governments, institutions and individuals. Since joining the firm 25 years ago, Erdoes has held senior roles across Asset & Wealth Management before becoming its CEO in 2009 and joining the JPMorgan Chase Operating Committee, the firm’s most senior management team.

Erdoes serves on the boards of the U.S.-China Business Council and the Robin Hood Foundation of New York City. She is also a board member of Georgetown University, where she earned her Mathematics undergraduate degree, and serves on the Global Advisory Council of Harvard University, where she received her MBA.

Erdoes and her husband, Philip, reside in New York City and have three daughters.

Rich Handler

CEO

Jefferies

Rich Handler

CEO

Rich Handler has been with Jefferies since 1990 and has served as CEO since 2001, making him the longest serving CEO on Wall Street. Rich serves as Chairman of Jefferies’ Global Diversity Council. He is also Chairman of the Handler Family Foundation, a nonprofit that has various philanthropic endeavors, including protecting endangered species and providing fully paid, 4-year undergraduate educations to 15 highly talented students from underserved communities each year. Prior to Jefferies, Rich worked at Drexel Burnham Lambert in the High Yield Bond Department. He received an MBA from Stanford University in 1987. Rich graduated magna cum laude with a B.A. in Economics from the University of Rochester in 1983, where he serves as Chairman of the Board of Trustees.

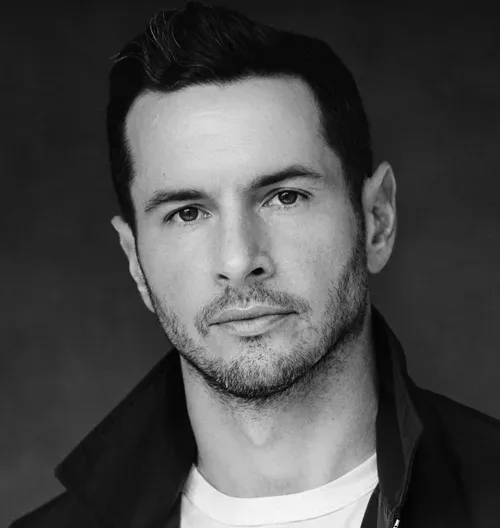

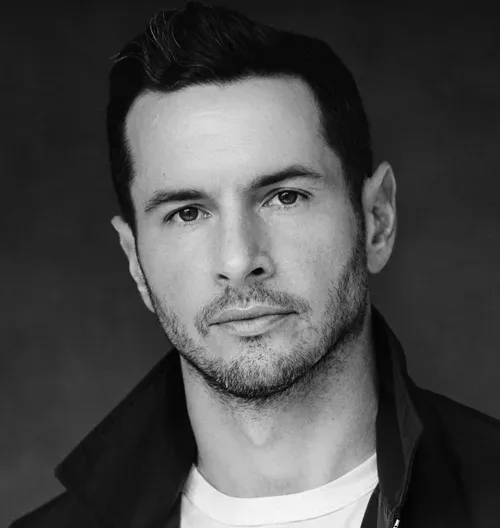

Munib Islam

Managing Partner and Chief Investment Officer

LTS One

Munib Islam

Managing Partner and Chief Investment Officer

Munib Islam is the Managing Partner and Chief Investment Officer of LTS One, an investment partnership he created in 2021 together with LTS Investments. Prior to starting LTS One, Munib was a Partner of Third Point LLC. Munib worked at Third Point LLC from 2004-2008 and rejoined the firm in 2011, after returning from Highbridge Capital, where he was a Managing Director and Portfolio Manager of Highbridge’s European Value Equities Fund. Before joining Third Point, Munib worked as an Associate at Oak Hill Capital as well as Lazard LLC. He received a B.A. in Economics from Dartmouth College (1997) and an MBA from the Graduate School of Business at Stanford University (2004). Munib is a Trustee of the Brearley School in New York City, is on the President’s Leadership Council at Dartmouth College, and served a term on the Stanford GSB Trust.

Alex Karnal

Co-Founder and CIO

Braidwell

Alex Karnal

Co-Founder and CIO

Alex Karnal is Co-Founder and CIO of Braidwell, a life science-focused investment management firm. Prior to co-founding Braidwell, Alex was a Partner, Managing Director, and Co-Portfolio Manager at Deerfield Management. He is a co-founder and Board chairman of The Institute for Life Changing Medicines, a nonprofit dedicated to developing medicines for people suffering from uncommon, life-threatening diseases, and serves on the Board of the Biotechnology Innovation Organization. During COVID-19, Alex was appointed by Governor Lamont to the Reopen Connecticut Advisory Group to provide counsel on the reemergence of the state’s economy, community, and education systems. Alex began his career as a member of Merrill Lynch’s Global Equity Linked Products Group and Capital Markets team. He received a B.S. from the Massachusetts Institute of Technology and an M.S. from Johns Hopkins University.

William Heard

Founder, CEO and CIO

Heard Capital LLC

William Heard

Founder, CEO and CIO

William Heard is the founder of Heard Capital LLC and serves as the Firm’s Chief Executive Officer and Chief Investment Officer.

Prior to founding Heard Capital LLC, Heard was a special situations analyst for Stark Investments LP where he covered investment opportunities across asset classes in the telecommunications, media, technology, financials, and energy sectors.

Heard is a graduate of Marquette University’s College of Business Administration where he earned a Bachelor of Science in Finance and Real Estate. While at Marquette, he founded and established the University’s Applied Investment Management (AIM) Program.

Heard is active in the philanthropic community, focusing his efforts on education and disadvantaged youth. He currently serves on the Leadership Council for A Better Chicago and the City Year Chicago Board of Directors.

Kim Y. Lew

CEO

Columbia Investment Management Company

Kim Y. Lew

CEO

Kim Y. Lew is CEO of Columbia Investment Management Company which manages the endowment of Columbia University in the city of New York. Previously, she was the CIO of Carnegie Corporation of New York, the private grant making foundation founded by Andrew Carnegie in 1911 which she joined from the Ford Foundation. Lew started her career in the middle market banking group of Chemical Bank and following business school joined Prudential Capital Group.

Lew graduated from the Wharton School of the University of Pennsylvania with a B.S in Economics and from the Harvard Graduate School of Business with an MBA. She is a CFA charterholder and has served as both a standard setter and grader.

Lew serves on the boards of Ariel Investment Management Mutual Funds and Girls Who Invest. She serves on the investment committees of the ACLU and National Gallery of Arts.

Joyce Meng

Founder

FACT Capital

Joyce Meng

Founder

Joyce Meng is the Founder of FACT Capital (launched 2019), which innovates on the hedge fund model and applies ‘first principles’ thinking to investment framework, portfolio/research transparency, technology use, and incentive alignment for long-term compounding. Prior to FACT, Ms. Meng was a Partner at Vernier Capital, and a Research Analyst at MSD Capital and Goldman Sachs Investment Partners.

Ms. Meng graduated summa cum laude from the Huntsman Program at UPenn (BA in International Studies, BS in Economics from Wharton). As a Rhodes Scholar, she graduated with distinction from Oxford University with an MSc in Financial Economics and an MSc in Economics for Development. She was also recognized as Forbes 30 under 30 (2014) and Wharton 40 under 40 (2015).

JJ Redick

Founder

ThreeFourTwo Productions

JJ Redick

Founder

JJ Redick is an NBA veteran, podcast host and co-founder of ThreeFourTwo Productions. After 15 seasons in the NBA, JJ Redick announced his retirement from the league on September 21, 2021.

Redick the former No. 11 pick of the 2006 Draft, played for six teams in his NBA career and spent last season with the New Orleans Pelicans and Dallas Mavericks. He averaged 12.8 points in 940 regular-season games and his 1,950 career makes from 3-point range rank him 15th in NBA history in that category.

JJ famously played college basketball for the Duke Blue Devils where he still remains their all-time leading scorer. He also set several other Duke records, including most points in a single season. Redick’s jersey was retired by Duke on February 4, 2007, making him just the 13th Duke player to have his jersey retired.

In February of 2016, JJ took his talent off court when he launched his first podcast and in 2017 that same podcast moved to The Ringer. In 2020, after completing 100 episodes, JJ started a production company, ThreeFourTwo Productions, where he launched his next podcast, The Old Man and The Three.

JJ currently lives in Brooklyn, NY with his wife Chelsea and their two sons Knox and Kai.

Lauren Taylor Wolfe

Co-Founder and Managing Partner

Impactive Capital

Lauren Taylor Wolfe

Co-Founder and Managing Partner

Lauren Taylor Wolfe is Co-Founder and Managing Partner of Impactive Capital, a $3 Billion active impact investing firm. Impactive Capital helps companies allocate capital effectively and ethically to drive more sustainable, profitable, and valuable businesses over the long run. Prior to founding Impactive Capital, from 2007-2017, Lauren was a Managing Director at the investment firm Blue Harbour Group, where she led investments in the technology, consumer, business, and healthcare services industries. Prior to joining Blue Harbour in 2007, Lauren was a Portfolio Manager at SIAR Capital, where she invested in small capitalization public companies and private companies.

Lauren received an MBA from The Wharton School at the University of Pennsylvania and a B.S. magna cum laude from Cornell University. Lauren is an Angel Member of 100 Women in Finance and has been active on various public and private boards including $4 Billion TEV Envestnet Inc [NYSE: ENV], $10 Billion TEV HD Supply [Nasdaq: HDS], and 30% Club Steering Committee.